A Biased View of The Wallace Insurance Agency

Wiki Article

The Wallace Insurance Agency Things To Know Before You Buy

Table of ContentsNot known Facts About The Wallace Insurance AgencyLittle Known Questions About The Wallace Insurance Agency.The smart Trick of The Wallace Insurance Agency That Nobody is DiscussingAn Unbiased View of The Wallace Insurance AgencyHow The Wallace Insurance Agency can Save You Time, Stress, and Money.

Like term life insurance, entire life plans provide a fatality advantage and various other benefits that we'll get right into later. The major benefit of an entire life plan is that it builds cash money value.The difference is that it offers the plan owner far more adaptability in regards to their premiums and cash money worth. Whereas a term or whole life policy locks in your rate, an universal policy permits you to pay what you're able to or intend to with each costs. It additionally allows you to adjust your survivor benefit throughout the policy, which can't be finished with other types of life insurance coverage.

If you have dependents, such as kids, a spouse, or parents you're taking care of and lack considerable riches it might remain in your benefit to purchase a policy also if you are reasonably young. https://sulky-appliance-156.notion.site/The-Wallace-Insurance-Agency-Navigating-the-Seas-of-Insurance-Coverage-e15a61fe08664c97b25693a4012de2ce?pvs=4. Should anything occur to you, you have the comfort to know that you'll leave your liked ones with the economic ways to settle any continuing to be expenses, cover the expenses of a funeral, and have some cash left over for the future

The Greatest Guide To The Wallace Insurance Agency

Bikers are optional adjustments that you can make to your plan to enhance your protection and fit your demands. If a policy owner needs funds to cover lasting treatment expenses, this biker, when activated, will give monthly settlements to cover those costs. This biker can waive premiums after that occasion so insurance coverage is not lost if the plan owner can not pay the month-to-month expenses of their plan.

Auto insurance spends for protected losses after a crash or case, shielding versus possible financial loss. Relying on your protection, a policy can protect you and your guests. The majority of states require chauffeurs to have auto insurance policy coverage.

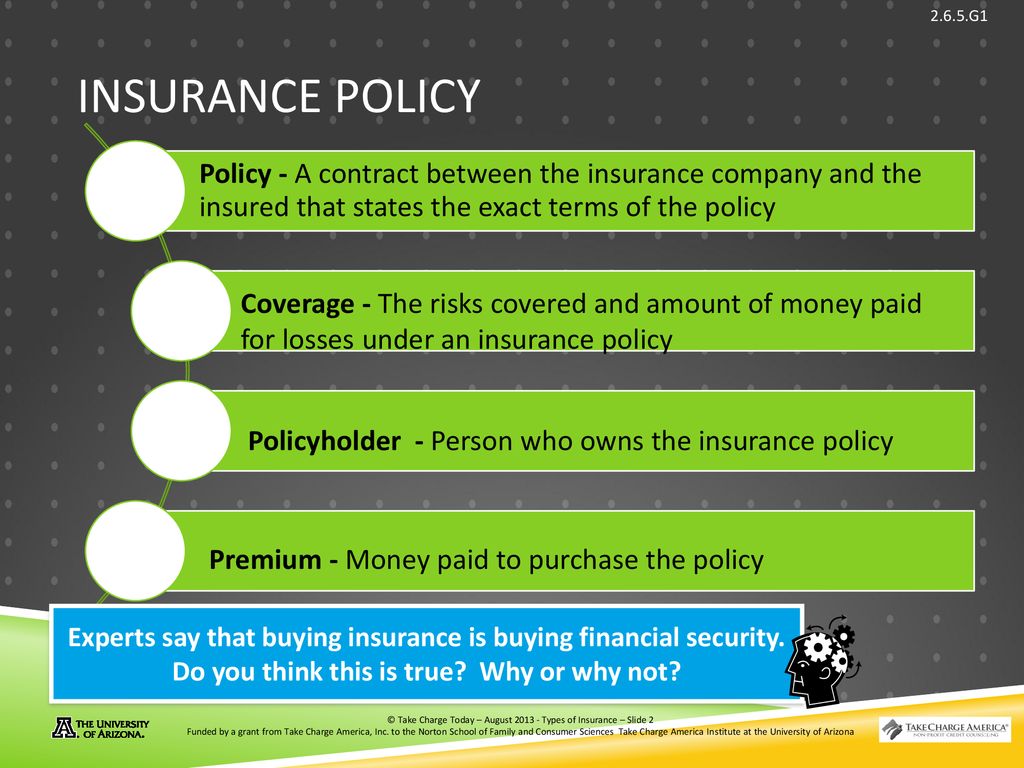

There are various sorts of insurance coverage products like life insurance policy strategies, term insurance, medical insurance, home insurance and even more. The core of any kind of insurance coverage plan is to supply you with security. Providing defense and minimizing your threat is the easy objective of insurance coverage. Making that small financial investment in any kind of insurance coverage plans, will certainly enable you to be tension-free and deal safety beforehand.

The The Wallace Insurance Agency PDFs

In addition to the life cover, they also offer maturity advantage, causing a terrific financial savings corpus for the future. A treasured possession like your vehicle or bike likewise needs defense in the kind of automobile insurance policy in order to safeguard you from out of pocket expenses in the direction of it repair work or uneventful loss.

This is where a term insurance policy strategy comes in useful. Secure the future of your family members and purchase a term insurance coverage policy that will aid your nominee or dependent receive a swelling amount or regular monthly payout to aid them deal with their monetary needs.

What Does The Wallace Insurance Agency Do?

Protect your life with insurance coverage and make certain that you live your life tension-free. Secure you and your family members with the coverage of your health and wellness insurance policy that will supply for your medical care costs.Life insurance policy strategies and term insurance coverage policies are highly vital to secure the future of your family, in your absence. Life insurance policy intends assists in methodical savings by designating funds in the type of premium every year.

Insurance policy motivates savings by lowering your expenditures in the long run. Insurance coverage provides for a reliable risk administration in life.

Report this wiki page